Trading Through Turbulence: Is Your Infrastructure Ready for the Next Market Shock?

Periods of extreme volatility are no longer rare events—they’ve become a defining feature of today’s trading landscape. From geopolitical announcements to unexpected rate decisions, markets can swing sharply in a matter of seconds, putting unprecedented stress on trading systems.

When volumes surge, latency-sensitive strategies are pushed to their limits, and legacy platforms often struggle to keep up. The real question is: have firms learned the right lessons from past shocks, and are their systems truly ready for the next one?

This article explores five critical infrastructure pillars that trading firms must address to remain competitive and resilient in this high-stakes environment.

Scalability is no longer optional, it’s strategic

Volatility is no longer an exception. It’s the new normal. And during stress periods, rigid legacy systems simply can’t scale fast enough to meet demand.

Trading infrastructure must be built with elasticity in mind. There are two primary approaches:

▸ Vertical scaling

Boosting the power of each component individually, for example, upgrading processors, optimizing code paths, or moving to event-driven microservices that consume fewer resources. This approach improves performance per node but doesn’t solve systemic bottlenecks.

▸ Horizontal scaling

The more sustainable path. It involves breaking the platform into modular services for example:

- Market data handlers

- Pricing engines

- OMS

- Risk and reporting tools

These services are deployed independently and scaled across multiple nodes behind a load balancer. This distributed architecture allows platforms to absorb demand spikes gracefully without degrading performance.

Firms that embraced modular designs have consistently outperformed their peers during recent market shocks.

Performance under pressure: Real-world test results

Scalability alone doesn’t guarantee performance. Systems must maintain low latency under extreme load, especially in milliseconds-sensitive environments.

One technology enabling this is Aeron, a high-performance messaging system used by modern trading platforms for ultra-fast, reliable communication.

Case in Point: U.S. Rate Announcement

During a recent U.S. Federal Reserve decision, a retail broker saw a 300% increase in message throughput. Thanks to Aeron’s transport layer and a modular backend, execution latency stayed flat, enabling the firm to handle the load without performance degradation.

To deliver this kind of resilience, teams need to continuously test and monitor their systems:

- Load testing with production-like simulations

- Real-time latency tracking across services

- Tooling like Azul for Java garbage collection optimization, which reduces jitter and keeps execution consistent

Automation: A must-have in hyper-active markets

Manual intervention doesn’t scale, and it certainly doesn’t keep up with volatility.

Leading trading platforms integrate automation across the trade lifecycle:

- DMA (Direct Market Access): for immediate order transmission

- Real-time risk checks: to avoid oversized trades in turbulent markets

- Auto-hedging: to manage exposure instantly across correlated positions

Example: Hedging on the fly

During the tech stock sector rotation earlier this year, one market-making desk’s automated hedging logic dynamically adjusted its exposure in real time, protecting P&L and avoiding human error all without manual input.

Automation doesn’t replace human oversight, it amplifies a firm’s ability to move fast, react intelligently, and stay in control.

Smarter execution with adaptive algorithms

Execution strategy determines profitability, especially when liquidity fragments and volumes explode.

Modern platforms embed adaptive, volume-aware algorithms to navigate these challenges. Key strategies include:

- High Volume Order (HVO) algos: reduce signaling and market impact for large trades

- Dispersion strategies: coordinate execution across correlated baskets

- Smart Order Routing (SOR): dynamically locate the best liquidity and price

Example: Navigating the Tariff Sell-Off

When the tech-heavy index plummeted after the U.S. tariff news, one platform’s SOR rerouted orders across multiple dark pools and venues, avoiding the primary exchange spike. The result: better average execution prices and lower slippage.

Post-mortem analysis of missed opportunities often leads back to poor automation or outdated execution logic.

Testing and validation: Benchmarking for the real world

Stress events expose weaknesses but also offer a valuable testing ground.

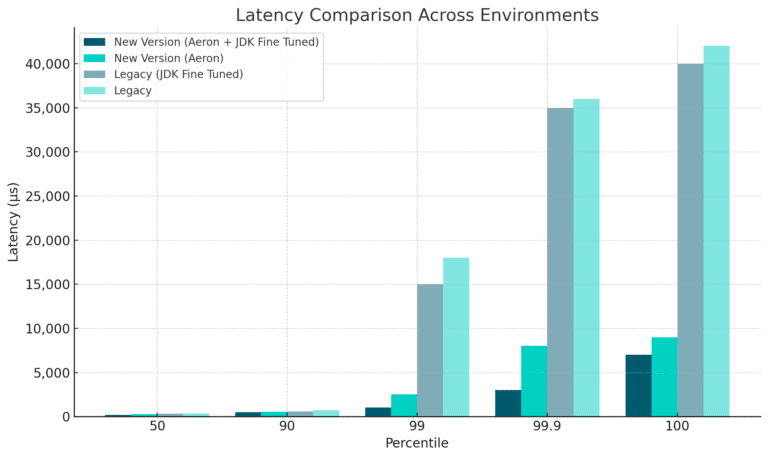

In a recent internal benchmark, we evaluated quote latency across five different middleware setups under simulated high-volume conditions.

Benchmark highlights

Takeaway: Legacy stacks showed a 4x latency spike at the 99.9th percentile. Modern setups maintained millisecond to sub-millisecond performance.

Looking ahead: Volatility isn’t over

As we approach another potential round of tariff announcements or any other macro event capable of shaking markets the firms that will thrive are those that have invested in:

Modular, horizontally scalable systems

- Real-time automation and risk handling

- Adaptive algorithms and smart routing

- Consistent latency optimization

- Continuous load testing and post-event tuning

Final thought

You can’t control volatility. But you can control how your infrastructure responds to it. The next 90 days could be even more unpredictable than the last. The question is: Will your platform keep up?

🎧 Prefer listening?

Discover our Horizon Trading Podcast version of this article, powered by AI.