Horizon Trading Solutions Attending BOCA 2026

Horizon Trading Solutions is pleased to confirm its attendance at BOCA 2026, 8–11 March 2026, the flagship conference of the FIA, celebrating 50 years of connecting the global cleared markets community. BOCA has brought together the people, insights, and opportunities that help define industry agendas for the year ahead. The conference creates a unique environment […]

Read MoreHorizon Trading Solutions Sponsors SGX Group Industry Appreciation & Awards Night 2026

Horizon Trading Solutions is proud to announce its sponsorship of the SGX Group Industry Appreciation & Awards Night 2026, taking place on 26 February 2026, from 6:00 PM to 9:00 PM at SGX Marketplace. The annual event brings together representatives from all Securities & Derivatives Clearing Members, with senior management and key staff typically in […]

Read MoreTokenization, 24/7 markets, and the next evolution of clearing

Tokenisation, 24/7 markets, and the next evolution of clearing: what it means for trading infrastructure Cleared derivatives markets have always been technology-driven. But the conversation is clearly shifting. It’s no longer only about “how do we comply with the next rule?” It’s also: how do we operate safely and efficiently in markets that are becoming more real-time, more digital, and increasingly continuous? Across […]

Read MoreMarket Making for Retail Structured Products: How to Scale Pricing, Hedging, and Risk Control

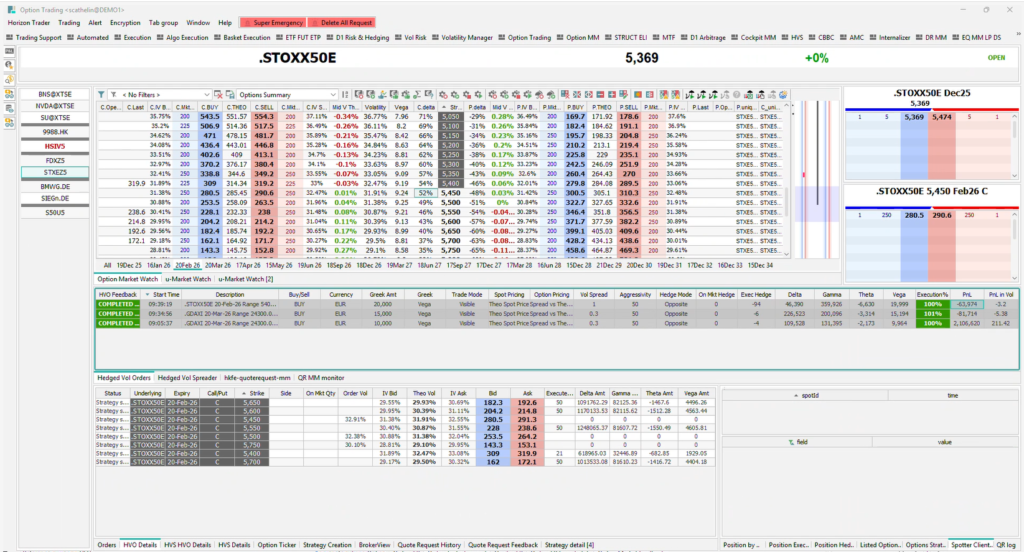

Market Making for Retail Structured Products: How to Scale Pricing, Hedging, and Risk Control Retail structured products have become a strategic growth engine for banks, brokers, and issuers across Europe. But scaling market making in structured products is no longer just a question of volume. It requires pricing accuracy, hedging efficiency, operational resilience, and full […]

Read MoreWhat Is Volatility Trading? A Practical Guide to Managing Gamma and Vega

What Is Volatility Trading? A Practical Guide to Managing Gamma and Vega Discover a practical approach to volatility trading, focused on controlling Gamma and Vega. Learn how traders use automation and technology to implement volatility strategies effectively. In volatile market conditions, volatility trading has become a core strategy for both speculative and hedging purposes. Rather […]

Read More5 Financial Markets Trends in 2026: From assets to events, from hours to 24/7, Institutionalization new markets, tokenization, new infrastructure.

5 Financial Markets Trends in 2026: From assets to events, from hours to always-on Introduction: 2026, the Year Market Structure Catches Up With Reality For decades, financial markets have been built around a stable architecture: assets, trading hours, clearing cycles, and well-defined venues. By 2026, that architecture is no longer sufficient. Across traditional finance and […]

Read MoreManaging Gamma & Vega: Customizable Volatility Trading Webinar

Managing Gamma and Vega: Practical and Customizable Frameworks for Volatility Trading Webinar Replay: Move from manual delta-hedging to scalable, systematic volatility execution. The practical challenge Bridging the gap between Volatility theory and live execution For professional desks in Asia’s fast-moving markets, the bottleneck is rarely the “view” it is the implementation. Translating volatility views into […]

Read MoreDisruptive Tech in Capital Markets: FIA Asia 2025 Insights

Disruptive Technologies in Capital Markets: What FIA Asia 2025 Revealed About AI, Tokenisation and Stablecoins AI is no longer a “future topic” in financial markets. At FIA Asia 2025, industry leaders from exchanges, trading firms, legal practices and industry bodies discussed how AI, digital assets, tokenisation and stablecoins are moving from experimentation into real market infrastructure. The key message was simple: innovation […]

Read MoreOCEANE Invest Selects Horizon Trading Solutions to Power ETF Market Making

ABU DHABI, Paris – 10th December, 2025 – Horizon Trading Solutions (Horizon), a leading global provider of multi-asset electronic trading technology, today announces a partnership with OCEANE Invest, a new Exchange Traded Fund (ETF) market maker, to deploy its automated market-making and algorithmic trading suite. The collaboration will support OCEANE Invest’s upcoming ETF listings on the […]

Read MorePrediction Markets: The new frontier shaping the future of trading

Prediction Markets: The new frontier shaping the future of trading For decades, financial markets have revolved around a familiar architecture: equities, commodities, FX, and rates surrounded by layers of derivatives for hedging and speculation. Today, something different is happening. Prediction markets venues where participants trade contracts on ‘whether events will happen’ are moving from the […]

Read MoreHorizon at FIA Asia Derivatives Conference 2025

We are pleased to announce that we will be participating as supportive sponsors at the FIA Asia Derivatives Conference 2025, taking place at The St. Regis Singapore. FIA Asia continues to be the premier gathering for the Asia-Pacific cleared derivatives community, bringing together industry leaders, market participants, and innovators to discuss the key developments shaping […]

Read MoreImproving Liquidity and Market Depth in Africa’s markets

Improving Liquidity & Market Depth in Africa’s Capital Markets: Why Market-Making and Payment Innovation Matter Africa’s capital markets are evolving rapidly, yet liquidity and market depth remain critical challenges across the continent. Fragmented infrastructures, limited market-making activity, and slow cross-border transaction processes restrict both investor participation and the growth of new financial instruments. However, progress […]

Read MoreWhy derivatives in the Middle East are still behind – And how to unlock their potential

Why derivatives in the Middle East are still behind – And how to unlock their potential Across the world, derivatives markets are booming. Equity index futures, single-stock options and commodities contracts are used every day to hedge risk, optimise portfolios and generate yield. In fast-growing financial centres in the Middle East, the infrastructure is increasingly […]

Read MoreHorizon Trading Solutions at the 28th ASEA Annual Conference

We’re proud to announce that we are a corporate sponsor of the 28th ASEA Annual Conference, taking place from November 26–28, 2025, at the Kigali Serena Hotel, hosted by the Rwanda Stock Exchange. This prestigious annual gathering brings together key players from across the African and global capital markets ecosystem , including securities exchanges, market […]

Read MoreShinhan Securities Vietnam Deploys Horizon Trading Solutions

Ho Chi Minh City & Paris – 23nd October, 2025 – Horizon Trading Solutions (Horizon), a leading global provider of multi-asset electronic trading technology, today announces that Shinhan Securities Vietnam, part of Shinhan Financial Group, is now live on its multi-asset trading and order management solution. The go-live supports Shinhan’s strategic goal of enhancing its […]

Read MoreFrom AMCs to ETD Execution: How Horizon Accelerates Time-to-Market

From AMCs to ETD Execution: The architecture behind faster time-to-market Practical patterns Horizon uses to launch faster and hedge smarter In Part 1 of this series, we explored the market forces shaping modern trading workflows. In this article, we’ll go deeper revealing how Horizon Trading Solutions delivers faster time-to-market through proven architectural patterns, trade-offs, and […]

Read MoreInnovating in Structured Products

Innovating at Speed in Structured Products & Derivatives: Key Takeaways from Zurich At “Oepfelbaum & Friends meets Horizon” in Zurich (2 Oct 2025), we explored one tough question: how to innovate faster in structured products and derivatives while raising the bar on risk management. Horizon Trading Solutions shared global market trends and client learnings. Oepfelbaum […]

Read MoreBuyandBuild2025

Buy & Build 2025: Three Key Takeaways from London’s TradingTech Summit The Buy & Build: The future of Capital Markets Technology conference took place on October 2nd in London gathered the leading minds in trading technology to discuss how capital markets firms are modernizing their infrastructures balancing innovation, interoperability, and AI. From legacy transformation to curated […]

Read MoreFOW Asia 2025

FOW Asia 2025 – Key Panel Highlights on Derivatives and Futures Markets The FOW Asia 2025 conference brought together leading market participants to discuss the latest trends shaping Asia’s derivatives and futures landscape. Two panels stood out, covering the future of Asia’s options markets and the opportunities in China’s rapidly evolving futures market. Here are […]

Read More