Discover Horizon’s latest innovations for Q1 2025

Agency Trading

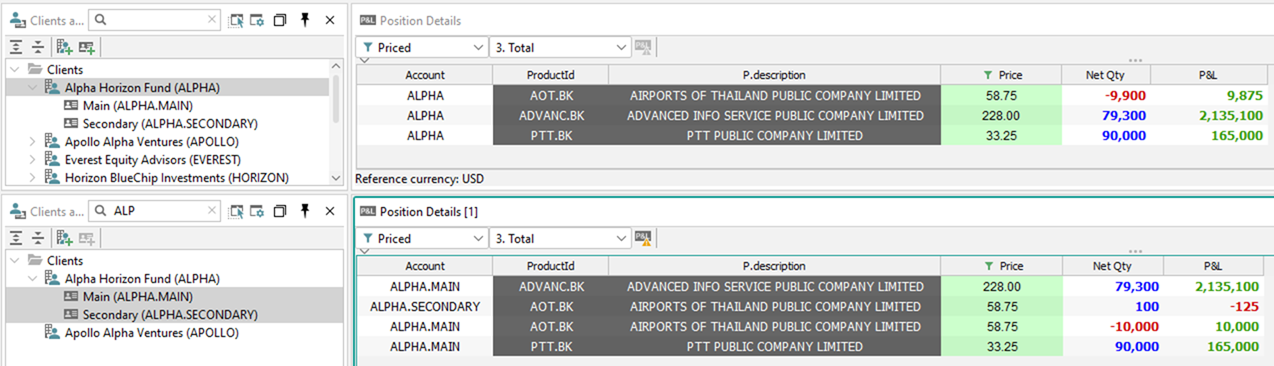

Horizon’s Position Management was initially designed to support market-making activities by tracking positions at the portfolio level. We have expanded this capability to our OEMS to manage positions at the client and account level, across high-touch and low-touch workflows. It provides agency trading with real-time visibility into intraday positions and enables advanced facilitation workflows, such as house fills, where a trader can execute a trade internally before unwinding it in the market. This flexibility also helps brokers manage error trade workflows, ensuring incorrect executions can be properly reassigned and resolved, thereby improving operational efficiency and client satisfaction.

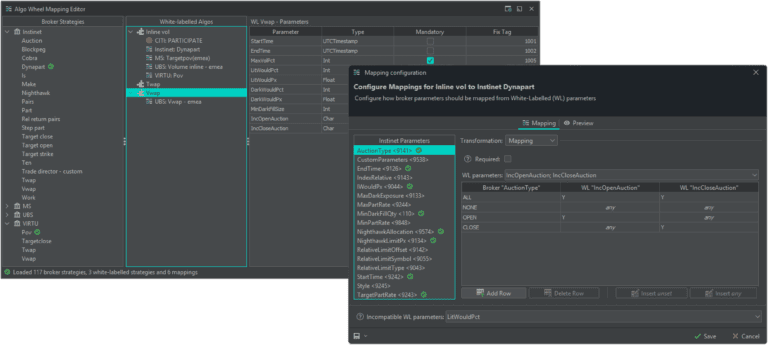

Horizon’s Algowheel empowers brokers to offer both their own execution algorithms and those of their broker partners as a white-labeled solution. Brokers can maintain and manage a list of approved algos and parameters, giving clients seamless access to a diverse range of execution strategies. Additionally, the solution provides real-time monitoring of client algo executions, ensuring transparency, efficiency, and optimized order handling. This enables brokers to enhance their service offering while maintaining full control over execution quality.

Horizon Extend - TaaS

Horizon Extend empowers users to customize trading logic, algorithms, and integrations beyond Horizon’s standard features. Previously limited to Scala, it now supports Java, making it accessible to a broader range of developers. With native APIs, seamless UI integration, and automated testing, Horizon Extend offers a flexible and powerful way to tailor the platform to specific needs.

Principal Trading

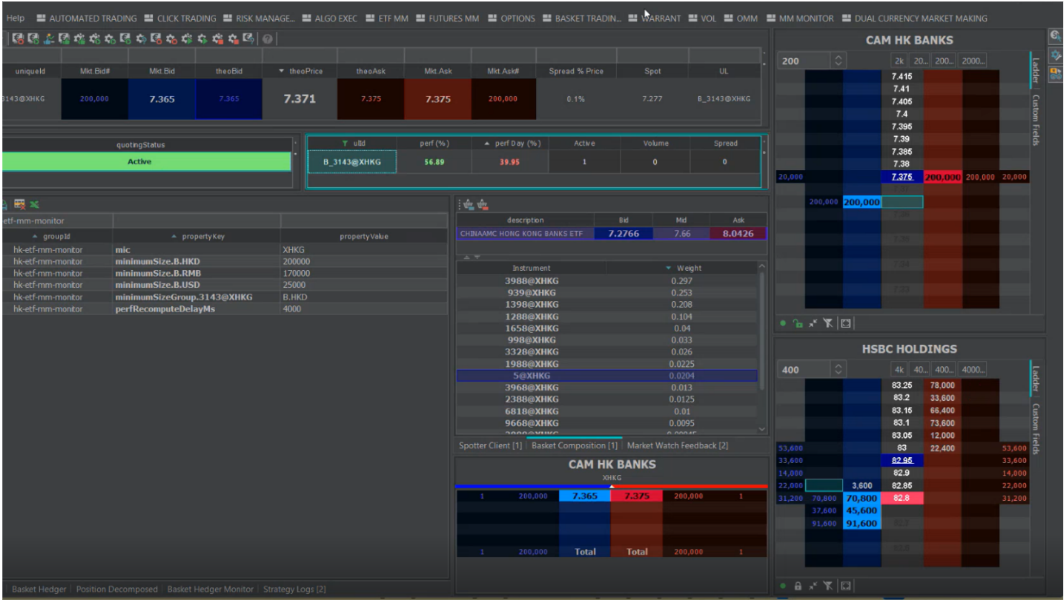

Horizon has upgraded its ETF Market Making capabilities, enabling firms to track performance against exchange obligations in real time. This feature ensures compliance with quantity and spread requirements, while also generating end-of-day reports for internal monitoring. With automated tracking, market makers can easily adjust spreads to stay compliant, reducing operational risk and improving efficiency.

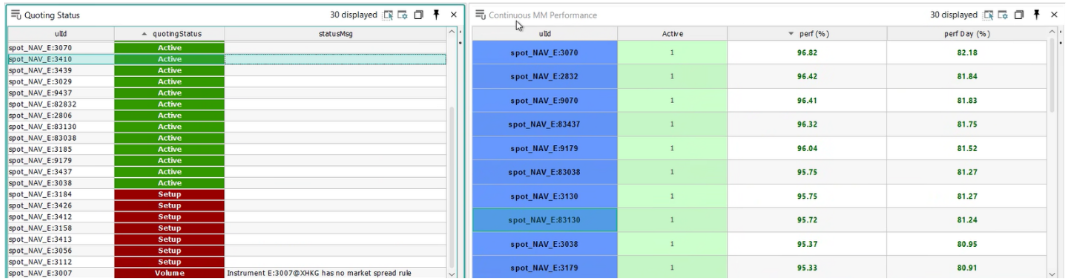

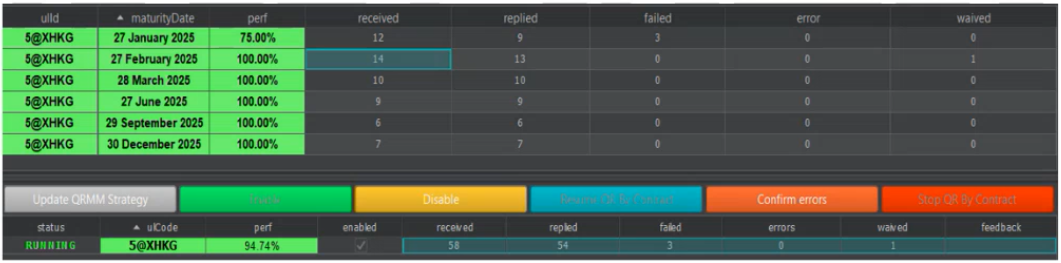

Horizon has enhanced its Quote Request Market Making functionalities, providing greater control and risk management. New features include automated scheduling based on market hours, a performance dashboard by underlying and maturity, and delta-based filtering to exclude high-risk options. Market makers can also pause and resume quote replies selectively and randomize response times, ensuring more efficient and strategic execution.

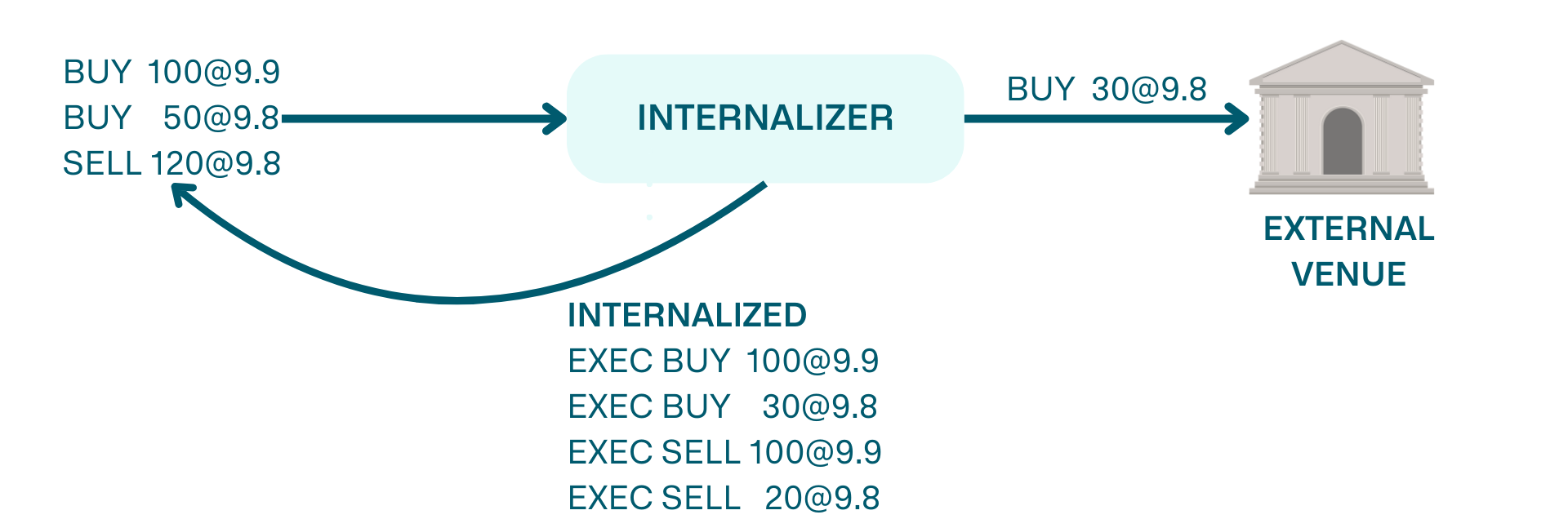

Horizon’s internalization module enables market makers to optimize execution by avoiding self-matching on regulated markets while ensuring a continuous market presence. By mirroring orders internally, our solution prevents instances where a firm’s own algorithms inadvertently match each other. Instead, it automatically cancels or adjusts orders to facilitate internal crosses, reducing market impact and improving cost efficiency. While initially developed for principal traders, this technology is equally relevant for agency brokers seeking to maximize internal crossing opportunities, minimizing trading costs while adhering to regulatory constraints.

Integrations

Horizon now integrates with Tradeweb AiEX to streamline ETF trading via RFQ multi-broker workflows. This integration allows traders to access Tradeweb’s automated price comparison and execution directly from Horizon, reducing complexity, improving execution speed, and ensuring better pricing. By eliminating manual steps, it enhances efficiency and lowers operational costs. This reinforces Horizon’s commitment to providing seamless multi-asset trading solutions.

Horizon now provides remote trading screens, allowing clients to securely access trading functionalities without a fixed connection. This solution offers flexibility, direct broker access, and a reliable backup option in case of connectivity issues. Clients can execute trades and monitor markets in real time, enhancing efficiency and resilience.