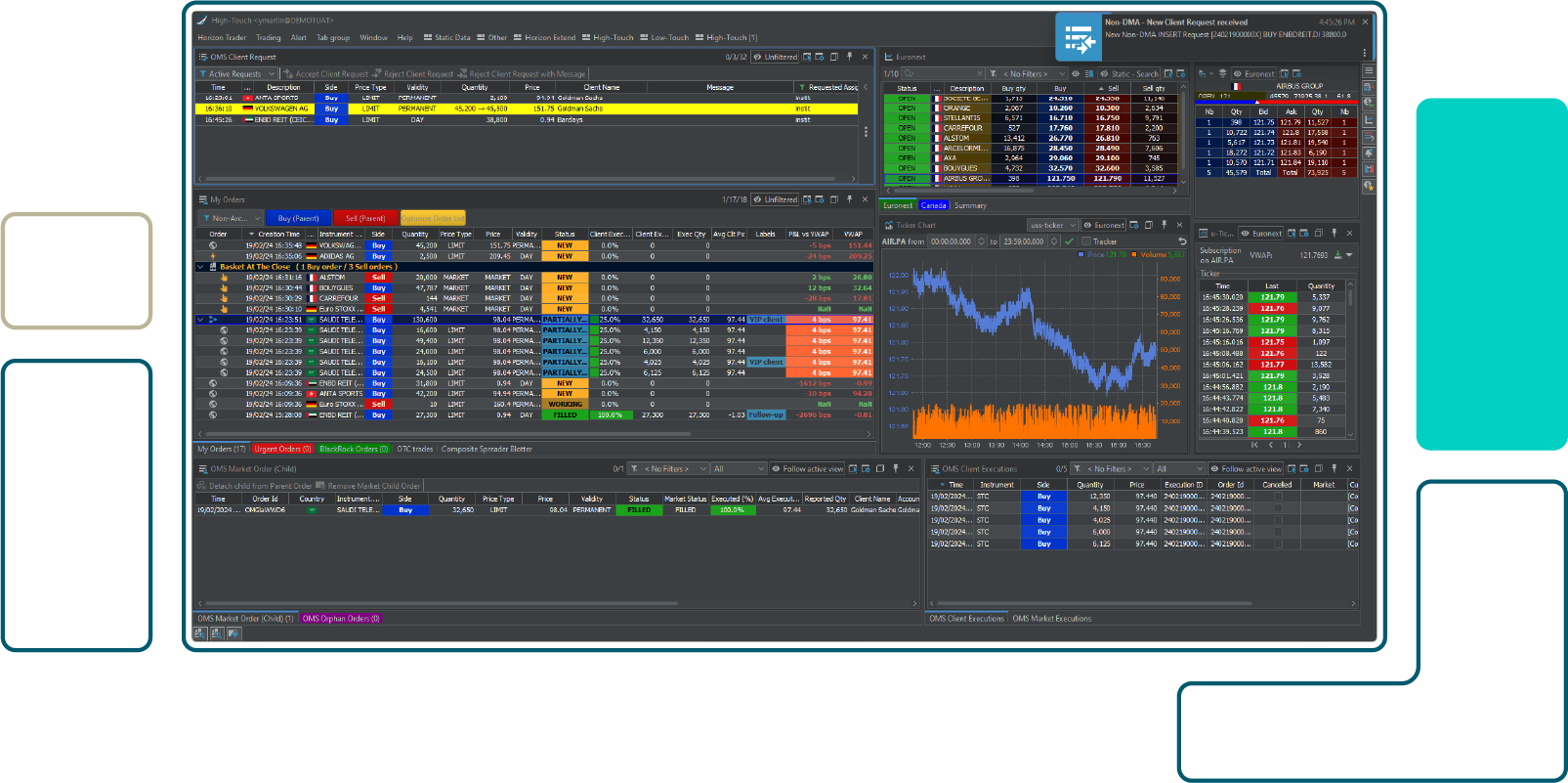

Horizon’s Order Execution Management System (OEMS) is built on years of experience, with proven stability and a complete suite of low- and high-touch Order Management System (OMS) features in a modern UI for a great user experience.

Horizon’s OEMS gives you the control you need. The platform provides an extensive permission layer coupled with trading desk permissioning and handover workflows.

And if, like many of our clients, you need to isolate order flows, Horizon gives you that capability. Order flows from retail, institutional and market making activities are fully segregated within the platform. Horizon provides a single platform that can accommodate all desks within a financial institution, while maintaining ethical standards and avoiding conflicts of interest.

Our workflows help your business operate efficiently, facilitating collaboration, enforcing order visibility, enhancing risk management and streamlining operations across and within desks.

Access single-stock and basket-based pre-trade analytics right from the order book, using Horizon integrations with leading TCA providers.

Tightly monitor execution quality by tracking – in real time – your implementation shortfall (in amount or bps) versus key benchmarks.

Horizon keeps you fully informed with Horizon Notify, a complete suite of order-related alerts and notifications, including:

Horizon Notify is fully integrated with Horizon Extend and its scripting capabilities (including Java and API). That means you can implement your own custom alerts and integrate third-party applications – easily.

Horizon lets you implement automatic release rules for your care order flow, so that traders on the desk can focus on tasks that generate revenue. The platform instantly creates child orders when incoming client orders match auto-release rule criteria. You can set release rules to trigger based on any combination of data points, including time, order amount, exchange, asset class, and client.

Horizon gives you extensive control over order executions. With an order composite, you can group multiple client orders (same instrument and side) into one order on the market. Executions are reported to each individual client order with the same average price.

Horizon Composite supports a variety of distribution rules, execution reporting policies and average price calculations. This flexible and robust approach lets you manage complex scenarios – such as adding or removing a constituent – that will update a composite order’s configuration throughout its life cycle.

With Strategy Composites (or order stitching), Horizon’s OEMS allows you to create derivative strategies using existing client orders as outright legs. The strategy’s executions are then dispatched on each leg.

Order Splitting lets you slice a care order transparently into two smaller orders that can be executed separately. You can also stitch or bulk a split order with other orders.

Horizon’s OEMS includes full capabilities to integrate algorithmic trading. Clients can make use of several market making algos – including aggressive market making, conservative follow limit and smart liquidity provision algos. As well, principal trading algos can be integrated into the OEMS.

A full range of algo types can be integrated: Automated order lists let you group client orders and delegate their execution to an algorithm or automaton. Basket trading allows trading a basket of stocks versus a hedge, focusing on detecting and taking opportunities to arbitrate an index future against the index basket. Horizon’s Composite Spreader – defined using ratios or quantities, target prices or a spread – allows automated trading of a spread between multiple legs. Pairs trading automates trading of two instruments – the primary and the hedge – bound by simple formulas computing order prices and quantities.

Subscribe and be the first to know about the latest news at Horizon.

Subscribe and be the first to know about the latest news at Horizon.

See a quick demo, download our brochure or speak to a team member

Paris: +33(0)1 42 60 94 90

Montréal: +1 (514) 548-3481

Hong Kong: +852 5803 0818

Bangkok: +66 (0) 2231 2390-4

China: +86 131 7211 4723

Dubaï: +971-586239345

Subscribe to our newsletter and stay updated on our latest news!

Please provide your details and your demo request and we will get back to you.

Upon entering the requested information, you will receive a link that will redirect you to a page where you can download our Brochure.