Managing Gamma and Vega: Practical and Customizable Frameworks for Volatility Trading

Webinar Replay: Move from manual delta-hedging to scalable, systematic volatility execution.

The practical challenge

Bridging the gap between Volatility theory and live execution

For professional desks in Asia’s fast-moving markets, the bottleneck is rarely the “view” it is the implementation.

Translating volatility views into delta-controlled positions often requires a taxing combination of fragmented systems and manual intervention. As portfolios grow, these manual processes hit a capacity wall, leading to execution path dependency and unintended directional risk.

This webinar focuses on volatility as a process and implementation question. We will explore how to structure hedged exposure to isolate Gamma and Vega while reducing the operational load on the desk.

Agenda

- The Scalability Constraint: Analyzing how manual position management limits bandwidth and consistency for specialized desks (Delta One, Options, Algos).

- Design-Led Exposure: Moving from trading instruments to trading Exposure Profiles, concentrating risk in volatility rather than direction.

- The HVO/HVS Framework: A deep dive into Hedged Volatility Orders and Spreads to automate the “heavy lifting” of delta neutrality.

- Portfolio-Level Management: Extending the framework to baskets, index components, and correlated assets.

- Live Implementation Demo: A technical walkthrough of structuring, hedging, and scaling volatility positions in real-time.

Features demonstration

Systems in Action

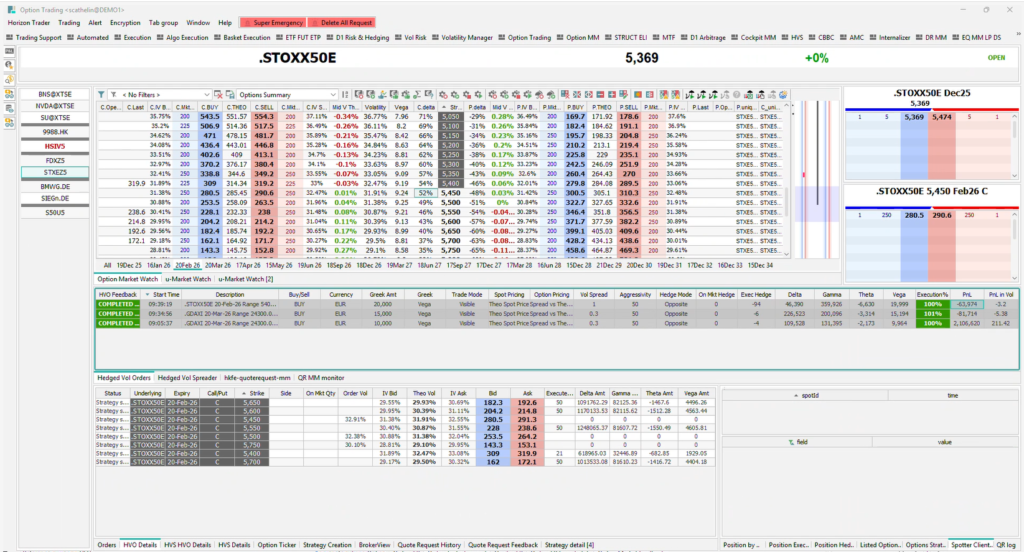

The session concludes with a live demonstration of Hedged Volatility Orders (HVO) and Hedged Volatility Spreads (HVS) in the Horizon Trading Solution environment.

Who should attend?

- Heads of Trading & Technology: Seeking to improve desk efficiency and institutionalize execution workflows.

- Derivatives Traders: Looking for better tools to manage complex structured product exposure (e.g., Warrants).

- Quant & Algo Traders: Interested in the systematic handling of path-dependent volatility positions.