The Future of Listed Derivatives Trading in Europe: challenges, opportunities and what needs to change

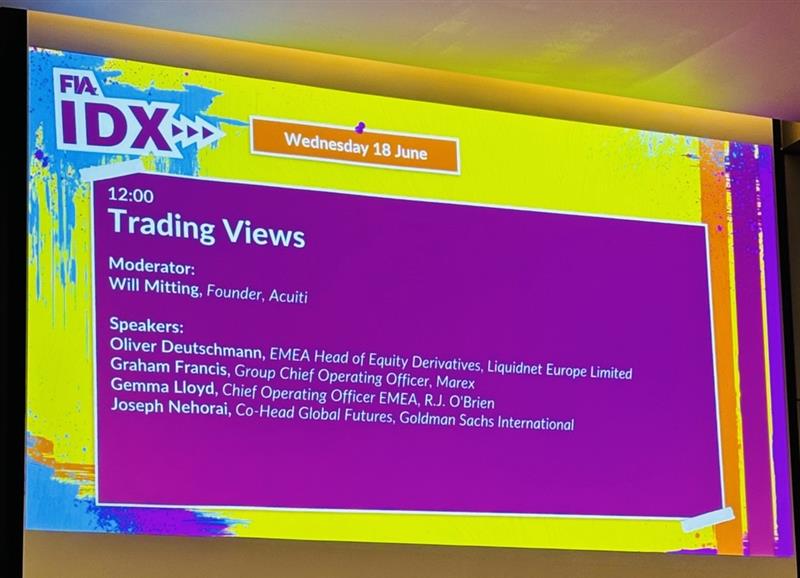

The landscape of listed derivatives trading in Europe is at a turning point. The “Trader Views” session at IDX London 2025 offered a wide-ranging and candid look at how the derivatives industry is evolving. From how execution desks handled the April volatility spike to deeper questions about automation, futurization, and the rise of 24/7 trading, the discussion revealed an industry that is adapting fast—but not without growing pains.

A Real-World Test: April 2025 volatility

One of the most telling moments in recent market history was the volatility seen in April. Compared to previous high-stress events—such as in 2020 or 2022—this time the system held up better:

- Liquidity returned faster: What once took months to stabilize post-crisis now happened in days.

- Record volumes were processed: Several firms saw the highest trading days in their history.

- Operational weak spots persisted: Straight-through processing (STP) rates were high, but even a 3% failure rate across consecutive high-volume days caused stress further down the post-trade chain.

This performance showed progress—but also reminded the industry that scale and automation must continue to advance across the entire trade lifecycle.

The Front Office is now fully connected

One major theme was the integration of the front, middle, and back office. The days of execution being isolated from risk, margin, and settlement are over.

Clients now expect:

- Real-time transparency

- Faster post-trade matching

- Direct visibility into their margin and risk exposure

Execution desks are no longer just about order placement—they’ve become real-time information hubs that link technology, risk, and client experience.

Automation is growing but voice isn’t dead

One major theme was the integration of the front, middle, and back office. The days of execution being isolated from risk, margin, and settlement are over.

Clients now expect:

- Real-time transparency

- Faster post-trade matching

- Direct visibility into their margin and risk exposure

Execution desks are no longer just about order placement—they’ve become real-time information hubs that link technology, risk, and client experience.

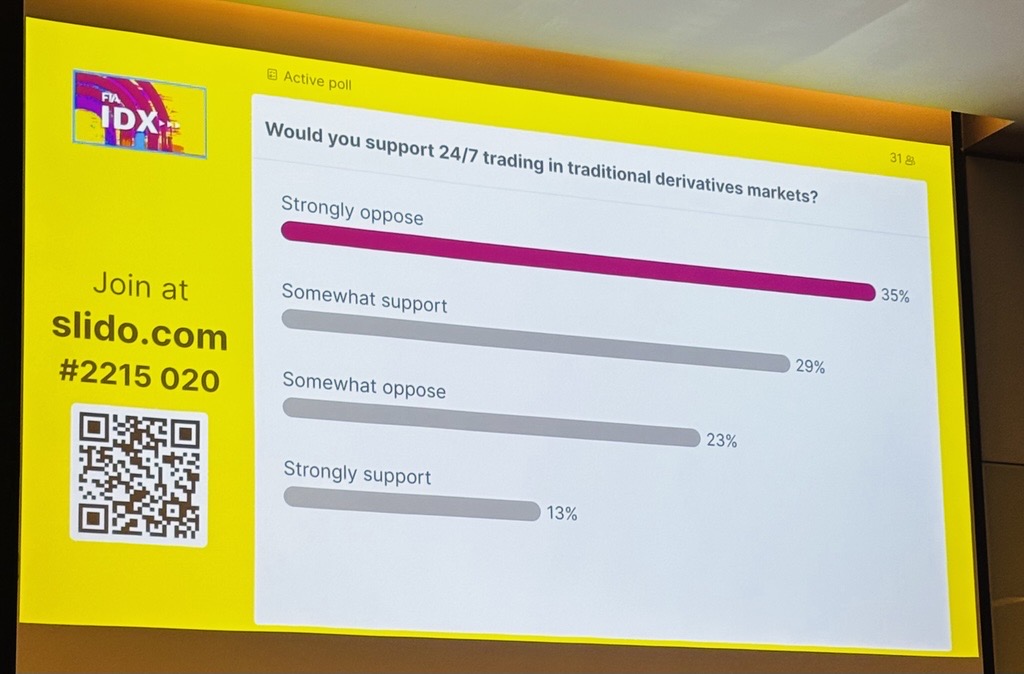

The 24/7 trading debate

One of the most debated topics was whether 24/7 trading in listed derivatives is realistic—or even desirable.

Arguments for included:

- Meeting global demand across time zones

- Keeping up with crypto-style platforms

- Making listed markets more accessible to retail investors

Arguments against highlighted:

- Liquidity gaps during off-hours that could disadvantage retail participants

- Operational cost and complexity, especially with current margining models

- Lack of infrastructure to support real-time collateral movement

The consensus? The industry isn’t there yet. Extending trading hours requires deep changes in post-trade infrastructure, liquidity provisioning, and margin workflows—not just technology tweaks.

A quiet revolution in Derivatives

Perhaps the most important insight was that listed derivatives are undergoing a renaissance:

- Futurisation is transforming previously OTC products into listed futures, from total return swaps to credit and custom baskets.

- Retailisation is bringing in a new generation of traders through micros, minis, and easier platform access.

- Margin optimisation is reshaping trading strategies and venue selection.

- Exchange competition is heating up, driven less by order book size and more by flexibility, efficiency, and cost.

What was once seen as a stable, mature segment of capital markets is now becoming a focal point for innovation.

Conclusion

The evolution of execution is about more than speed—it’s about resilience, intelligence, and client-centric infrastructure. Whether through automation, infrastructure upgrades, or product innovation, the derivatives industry is clearly moving forward.

But it must also remain cautious: growing complexity, rising operational costs, and regulatory shifts continue to demand thoughtful investment in the systems and people that make trading work—front to back.

Want to future-proof your trading operations?

Learn how our modular trading infrastructure and advanced execution tools can help you scale, innovate, and stay compliant in a fast-evolving market.