The Future of Option Trading in Europe: challenges, opportunities, and what needs to change

The European options market is at a pivotal crossroads. During the recent IDX London 2025 panel on The Future of Options in Europe, industry leaders discussed why the region continues to lag far behind the U.S. in both retail and institutional participation and what needs to change for Europe to unlock its full potential.

Why is Europe still behind?

Why is Europe still behind?

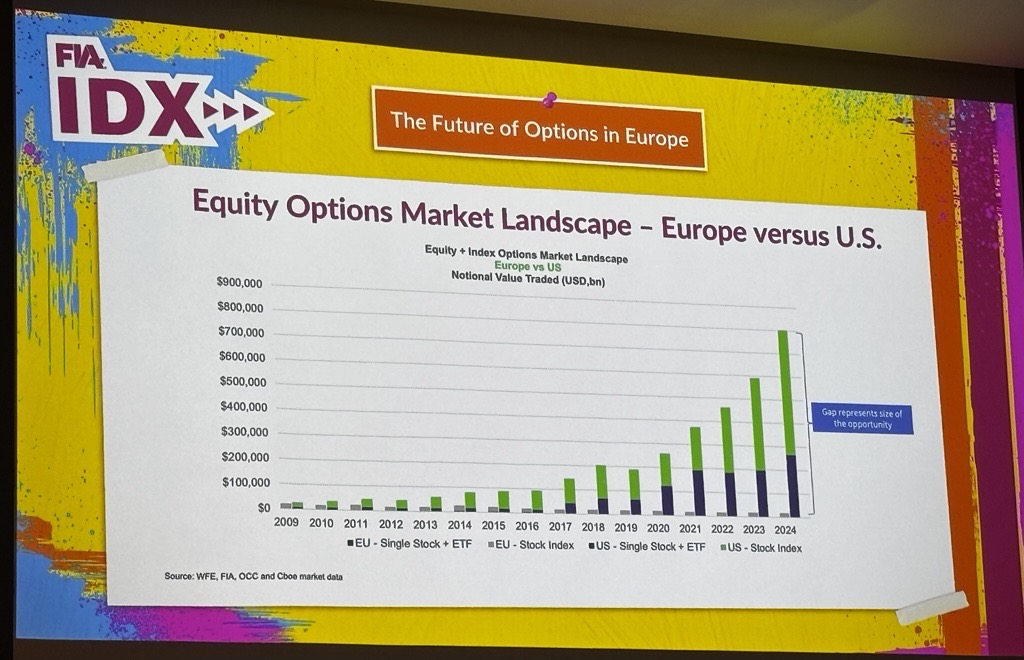

While U.S. options markets have grown exponentially since 2009, becoming roughly 30 times the size of their European counterparts, Europe remains fragmented both in infrastructure and investor behavior. Key takeaways:

- Cultural Differences Matter: In the U.S., a lack of government-backed pensions incentivizes personal investment. Europeans, on the other hand, often rely on structured savings and government protections, resulting in lower retail engagement.

- Fragmented Market Structure: Europe’s multiple exchanges, clearinghouses, and national regulations create inefficiencies. Unlike the U.S., which benefits from a centralized clearinghouse (OCC) and a single CSD (DTCC), Europe’s complexity drives up costs and limits liquidity.

- Retail Participation Varies Widely: In the Netherlands, retail investors drive up to 45% of options volume—thanks, in part, to a former education minister who introduced options trading into the national curriculum. Meanwhile, retail participation in France and the UK remains minimal due to regulatory barriers and limited education.

The growth opportunity is real

Despite the challenges, the European equity options market is growing, with +20% year-to-date volume growth in 2025. There is a clear appetite for European risk exposure from U.S. firms especially as global asset reallocation gains momentum.

However, infrastructure barriers are blocking the flow. As one panelist put it, “If you’re coming from the U.S. and want to build from scratch in Europe, you quickly discover how difficult it is.”

What needs to change?

1. Harmonization Across Exchanges

Differences in contract specs, expiry times, and even trading calendars between European venues (e.g., Germany, Italy, France) create unnecessary complexity. Unified specifications across exchanges like Eurex, Euronext, and Nasdaq Europe would simplify access and improve transparency.

2. Post-Trade Reform

The real “pain point” lies in post-trade fragmentation. Industry leaders called for cross-CCP offsets and collateral efficiency improvements, emphasizing that post-trade modernization is essential to unlock deeper on-screen liquidity.

3. Regulatory Adjustments

European regulators, particularly ESMA, must reconsider thresholds for block trades and trade deferrals. Higher thresholds would push more trades onto the screen, enhancing transparency and price discovery.

4. Retail Engagement Through Education and Accessibility

While retail interest exists, access remains difficult. Solutions discussed include:

- More educational initiatives in local languages.

- Launching mini-options to reduce notional barriers (e.g., LVMH, ASML, soon German stocks).

- Revisiting investment protection rules that discourage risk-taking but also limit capital growth.

A CBOE study released during IDX supports these measures and offers clear recommendations for boosting European retail options trading.

What’s next?

There’s growing consensus that now is the time to build a true European capital markets union not just in vision, but in operational reality. In the context of geopolitical shifts, rising interest in European assets, and stagnating U.S. growth, Europe must remove self-imposed structural barriers.

As panelists concluded, the opportunity is massive but coordination between exchanges, CCPs, and regulators is essential. It’s time for the industry to come together and make options trading in Europe simpler, more efficient, and more inclusive.

Looking to learn more about Listed Options Market Making?

Download our brochure.