What Is Volatility Trading? A Practical Guide to Managing Gamma and Vega

Discover a practical approach to volatility trading, focused on controlling Gamma and Vega. Learn how traders use automation and technology to implement volatility strategies effectively.

In volatile market conditions, volatility trading has become a core strategy for both speculative and hedging purposes. Rather than focusing solely on price direction, volatility trading allows traders to express views on market uncertainty itself.

During our recent webinar on volatility trading, industry experts shared a practical framework for managing Gamma and Vega, two of the most important options Greeks. This article summarises the key takeaways and explains how traders can move from theory to real-world implementation of volatility strategies.

What Is Volatility Trading?

Volatility trading involves taking positions based on expectations of future market volatility, rather than predicting whether prices will rise or fall. It is widely used by:

options traders

market makers

institutional desks

firms seeking to hedge portfolio risk

At the heart of volatility trading lie options Greeks, which quantify how option prices react to different market variables. Among them, Gamma and Vega are critical for understanding and controlling risk.

Understanding Gamma and Vega in Volatility Trading

Effective volatility trading starts with a clear understanding of how Gamma and Vega behave.

Gamma measures how quickly an option’s delta changes as the underlying price moves. High Gamma means small price moves can significantly alter exposure, increasing both opportunity and risk.

Vega measures an option’s sensitivity to changes in implied volatility. When implied volatility rises or falls, Vega determines how much the option’s value will change.

In practice, volatility traders must continuously monitor and balance Gamma and Vega exposure, especially during periods of market stress or event-driven volatility.

Practical Volatility Trading Strategies: From Theory to Execution

One of the key messages from the webinar was that successful volatility trading requires more than theoretical knowledge. Traders need tools and workflows that allow them to:

visualise Gamma and Vega exposure in real time

adjust positions quickly as market conditions change

automate execution to reduce operational risk

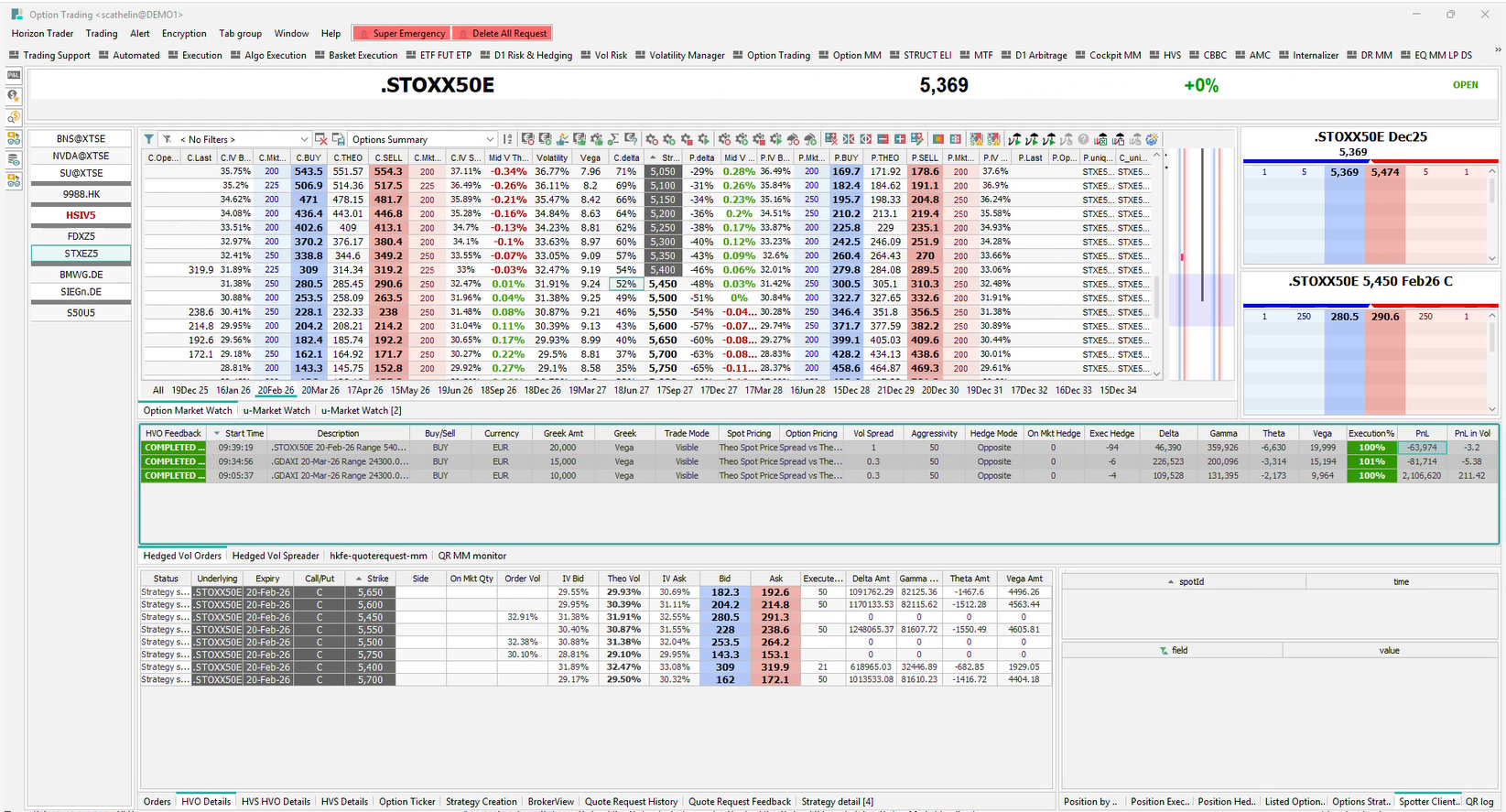

The speakers demonstrated how technology and automation play a crucial role in modern volatility trading, enabling traders to implement strategies efficiently across multiple instruments and markets.

Implementing Volatility Trades with Automation

The webinar showcased how traders can use dedicated volatility tools, such as Hedged Volatility Orders (HVOs) and Hedged Volatility Strategies (HVSs), to execute volatility trades more effectively.

These tools allow traders to:

express volatility views directly

manage Gamma and Vega dynamically

deploy volatility strategies for both speculation and hedging

By automating key elements of the trading process, traders gain greater control over risk while improving execution speed and consistency.

Key Takeaways for Volatility Traders

To trade volatility successfully in today’s markets:

Understand Gamma and Vega deeply, not just conceptually but operationally

Use technology and automation to manage complex risk profiles

Focus on practical implementation, not just theoretical models

Volatility trading is increasingly a technology-driven discipline, where execution quality and risk control are just as important as market views.

Want to see these concepts in action?

Watch the replay of our webinar to explore real-world volatility trading use cases, practical Gamma and Vega management, and live demonstrations of volatility trading workflows.